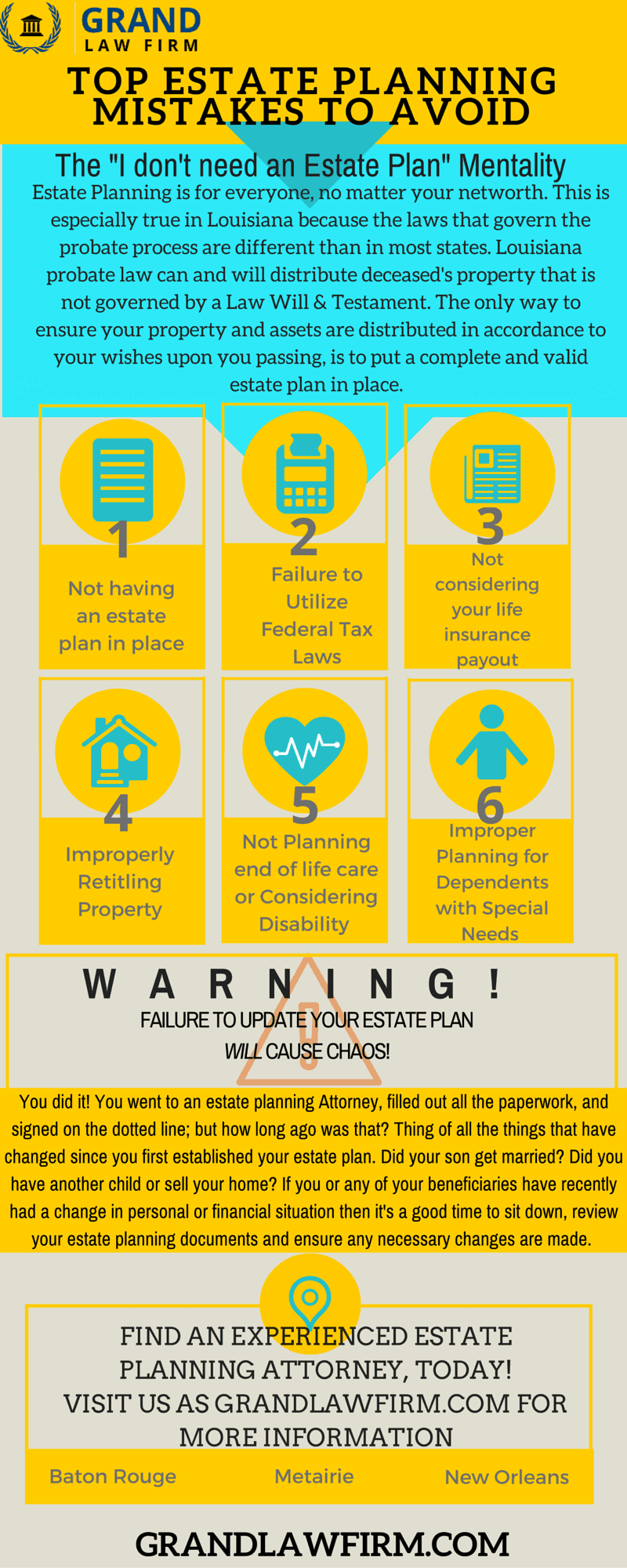

Top Estate Planning Mistakes to Avoid in 2016

-

Not Having An Estate Plan

- Never establishing an Estate Plan is the number one mistake many people make when they plan for their future. There are a lot of very understandable reasons someone might avoid estate planning but none of them compare to the many reasons you should.

- Many people think that they don’t need estate planning because it can be uncomfortable to think about what will happen upon their death but that is exactly the problem that estate planning solves. A valid, complete and comprehensive estate plan takes the guess work out of end of life care, distribution of assets and can even include burial or other funeral arrangements.

- The truth is that establishing an estate plan is the only way to ensure that your wishes are carried out upon your passing.

-

Failure to Utilize Federal Estate Tax Laws

- In order to properly utilize federal estate tax breaks one must first determine what his or her taxable estate includes. This can be a considerable undertaking in and of itself. Assets such as real estate, stocks, bank accounts, IRAs and life insurance policies can and will be included in your taxable estate.

- The threshold for what can pass from your estate to your loved one has changed several times over the past 12 years. These changes make the largest impact when one spouse passes and leaves the entirety of his or her estate to the surviving spouse. Without proper estate planning, this sudden influx in the surviving spouse’s estate can lead to a higher rate of taxation for his or her family upon his or her death.

- This problem can often be resolved by establishing one or more Trust Accounts and can save your family a considerable amount of money.

-

Not Considering Your Life Insurance Payout

- As previously mentioned, Life Insurance proceeds are typically included as part of the deceased estate. This could mean that anywhere from 35-50% of your Life Insurance benefits, the benefits that you carefully paid into in order to provide for your loved ones, could be taken in IRS or state taxes.

- Talk to a qualified estate planning and trust attorney to discuss an Irrevocable Trust which can often be established to help you and your family avoid losing the money you worked so hard to put away in the first place.

-

Improperly Retitling Property

- Often times, an individual will add his or her children grandchildren or other family members to real estate deeds or even bank accounts in an attempt to avoid or reduce probate taxes down the road, but this can lead to far more issues than it resolves.

- When you add someone’s name to your account or property title you are financially linking yourself to that person. This means that you are opening yourself up to his or her creditors and other legal settlements that could result in loss of the property you wanted to leave them.

- Additionally, if the property in question is worth more than $13,000 there are federal and state gift taxes that must be considered.

- There are many solutions to passing property smoothly from yourself to another upon your passing that should be discussed with an estate planning attorney.

-

Not Planning for End of Life Care or considering Disability

- Death is not the only reason that someone should establish an estate plan. End of Life or Disability care are also something to consider. This section of estate planning can often be the most difficult part to consider but it can also end up being the most critical. Unfortunately, many people can face long term disability or otherwise require long term medical care or treatment as he or she approached the end of his or her life. This long term care frequently results in a strain on both personal and financial affairs that can be eased with proper estate planning. Decision such as who will handle you finances, raise your children, maintain your home/living situation or even make healthcare decisions on your behalf can all be established through comprehensive estate planning. These decisions are often established through varied Power of Attorney documents, and Living Trusts.

-

Failure to Plan Loved Ones With Disabilities

- If you presently support a loved one who has a mental or physical disability it is critical to establish proper care for that person in the event of your own passing. This is essential for many reasons; first, if your child is presently receiving government benefits, such as Medicaid, and you die and leave them your entire estate outright or in an improperly protected Trust Account then he or she may no longer qualify for those government benefits. There is a specific type of Trust Account known as a Supplemental Need Trust that an estate planning attorney can assist you in forming to ensure that your child both inherits all or part of your estate without causing the loss of government benefits he or she may still require.

-

*Bonus* Failure to Update Your Estate Plan

- Alright, you did it! You went, met with an attorney, went through all the details of your estate and signed all the right documents, but when did you do all that? Was it a year ago? Five years ago or maybe even ten?

- Think about all of things in your life that have changed since you first established your estate plan. If any of your beneficiaries have gotten married or divorced, had children or a large financial or personal change since that last time you sat down with your attorney? Have you moved states or otherwise sold or acquired property? All these reasons and more are why it is critical to regularly update and review your personal estate planning documents.