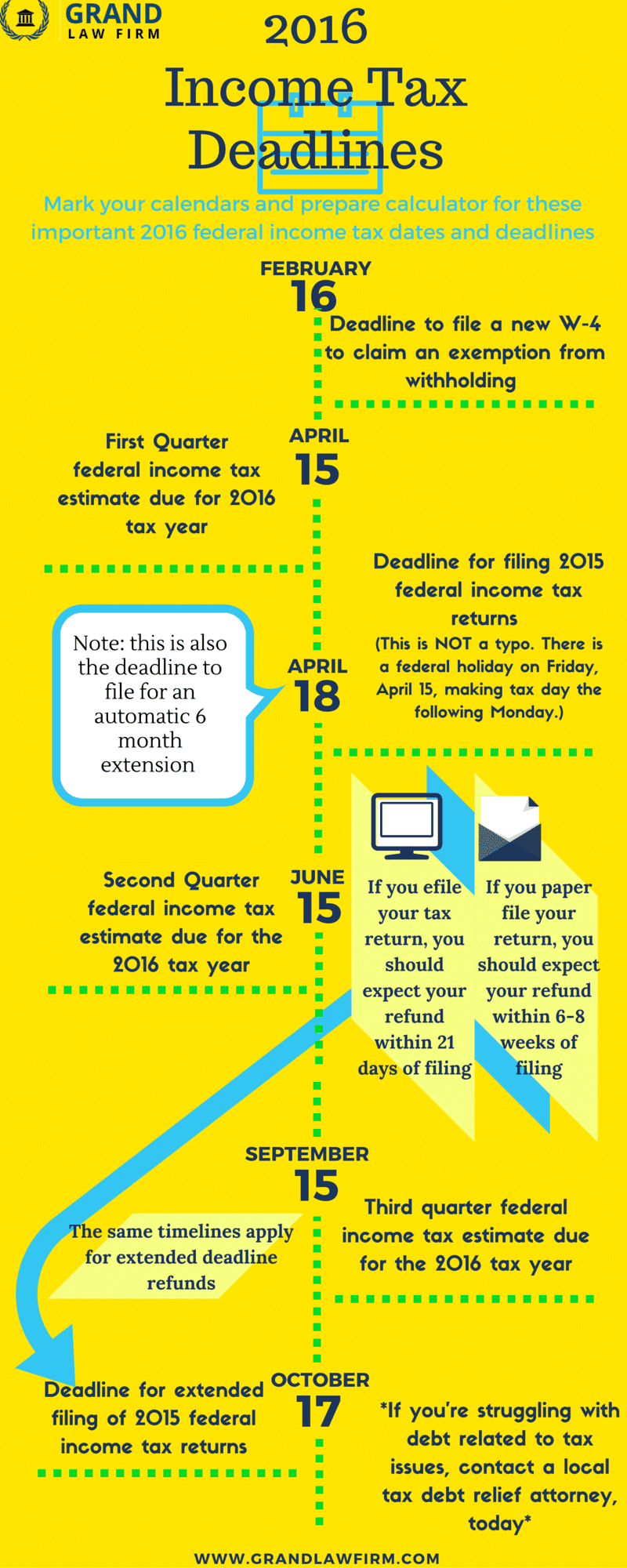

Though tax dates and deadlines stay fairly consistent from year to year, 2016 brings with it some slight changes to the line-up. Check out these 6 dates that you’d be foolish to forget this federal tax return season.

-February 16th: is the deadline to file a new W-4 to claim an exemption from withholding for the 2016 tax year

-April 15th is the deadline for first quarter federal income tax estimate due for 2016 tax year

-April18th is the deadline for filing 2015 federal income tax returns

(This is NOT a typo. There is a federal holiday on Friday, April 15, making tax day the following Monday.)

June 15th is the deadline for second-quarter federal income tax estimate due for the 2016 tax year

September 15th Third quarter federal income tax estimate due for the 2016 tax year

October 17th is the deadline for extended filing of 2015 federal income tax returns. Tax returns submitted after this date will be open to receiving penalties for late filing from the IRS.

Now for the moment ever tax filer looks forward to: receiving his or her refund.

When will you receive your 2015 tax refund?

If you efile your tax return, you should expect your refund within 21 days of filing

If you paper file your return, you should expect your refund within 6-8 weeks of filing

If you’re struggling with tax debt and not sure where to turn, contact a qualified tax debt relief attorney in your area to find out what your debt relief options could include.

You may also be interested in our Louisiana Tax Debt Relief page which includes reasons you may need the assistance of a qualified attorney to find relief from tax debt.